Click here to view larger image.

For its COVID-19 response efforts, the County of Hawai‘i will receive $80 million in Federal CARES Act funding and has partnered with local organizations to provide direct relief programs for residents of Hawai‘i Island who have been impacted by the pandemic. If you or your business has been struggling financially due to COVID-19, please consider submitting applications for the following resources that may be relevant to your particular situation:

County of Hawai‘i Financial Navigator Program

This free program was established to help residents navigate critical financial issues related to the COVID-19 pandemic. This service can help residents access available programs and services to manage income disruptions and other financial concerns. Financial Navigators help residents one-on-one to triage personal financial issues, identify immediate action steps to manage expenses and maximize income, and make referrals to other services. The County of Hawai‘i will offer these Financial Navigator services in partnership with Hawai‘i First Federal Credit Union and its non-profit arm. Call 808-933-6600 or visit: https://www.hawaiifirstfcu.com/community-resource-center/ to connect with a Navigator.

County of Hawai‘i Rent and Mortgage Assistance Program (RMAP)

Provides up to $2,000 per month (March-December 2020) for eligible households at or below 140% of the area median index (AMI) for eligible applicants who have had their income impacted due to COVID-19. For more information visit https://sites.google.com/view/hawaiicountyrmap.

County of Hawai‘i Non-Governmental Utilities Assistance Program

Provides up to $500 in utilities (gas, electric or non-government water) bill assistance for households at or below 100% of the area median index (AMI) who have had their income impacted due to COVID-19. For more information and to apply on-line at https://hceoc.net/.

County of Hawai‘i Holomua Hawaii Small Business Relief and Recovery Fund

Provides one-time reimbursement grants up to $10,000 to County businesses and nonprofit organizations for costs incurred from business interruption due to the COVID-19 emergency (beginning March 23, 2020). Read information before applying here: https://www.holomuahawaii.com/index.html.

Rapid Response Landlord Tenant Mediation Program

West Hawai‘i and Ku‘ikahi Mediation Center(s) are offering rapid-response mediation services for landlord-tenant relationships strained by COVID-19 conditions. Call (808) 885‑5525 or (808) 935-7844. For information visit the websites at: https://whmediation.org/our-services/landlord-tenant/ or https://hawaiimediation.org/landlordtenant/.

On Monday, March 23, Governor David Ige signed a third supplemental proclamation regarding our State of Emergency, ordering residents in the State of Hawai‘i to stay-at-home, work-from-home effective tonight; 12:01 a.m. Wednesday, March 25, 2020. This proclamation will be in effect until April 30, 2020.

In order for the state to provide essential services, there are exemptions in the following categories: Healthcare services, grocery stores and pharmacies, food production and farming, public and private schools, restaurants offering take-out services, hotels and motels, construction, and essential government functions. I realize that the responsibilities we have as employees working in the state of Hawai‘i can be taxing and very important. However, for the foreseeable future, we should do our part to limit the spread of COVID-19 and perform any work we can from home.

While we are strongly urged to remain in our homes for the duration of the mandate, the following outdoor tasks are permitted: accessing healthcare, purchasing food, medicine, and gasoline, taking care of the elderly, minors, and those with disabilities, returning to a place of residence outside of Hawai‘i, picking up educational materials for distance learning, receiving meals and any other related services, and outdoor exercise – including surfing, swimming and walking pets on a leash.

Any non-compliance of Governor Ige's mandate can be punishable by a fine of up to $5,000 or up to one year in jail or both, but the most compelling reason to pitch in and do our part is crystal-clear: our actions will protect the most vulnerable members of our families. For the next 36 days, please join me and do your part: stay at home, work from home, monitor your health for symptoms and look after each other.

‘A‘ohe hana nui ke alu ‘ia – No task is too big when done together by all.

Mahalo,

Senator Dru Mamo Kanuha

Senatorial District 3 | Kona, Ka‘ū

*For questions about exemptions, email CovidExemption@hawaii.gov.

**Those who would like to volunteer ideas or resources to assist in the response effort should email CovidKokua@hawaii.gov.

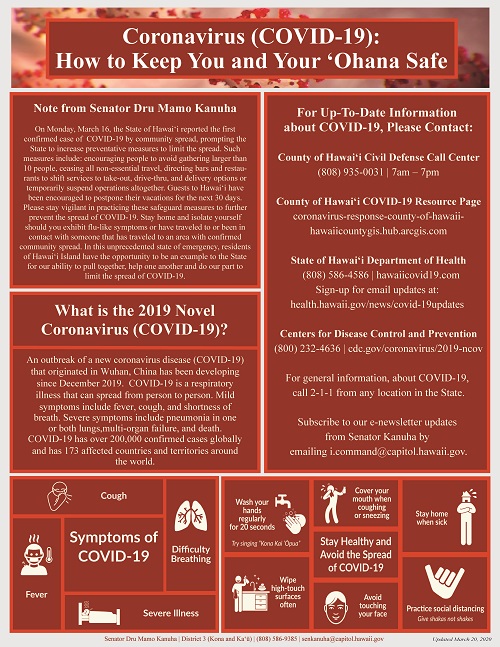

The Department of Health (DOH) is committed to sharing information about COVID-19 as it becomes available. Everyone can help prevent the spread of COVID-19 with these daily actions:

| • | Wash your hands often with soap and water for at least 20 seconds |

| • | Avoid touching your eyes, nose, and mouth with unwashed hands |

| • | Avoid close contact with people who are sick |

| • | Stay home when you are sick |

| • | Cover your cough or sneeze with a tissue, then throw the tissue in the trash. |

| • | Clean and disinfect frequently touched objects and surfaces using a regular household cleaning spray or wipe |

| • | CDC does not recommend people who are well to wear a facemask to protect themselves from COVID-19. Keep in mind that supplies are limited, and we need to make sure that there are enough masks for our front-line health care workers. If you are sick, then wear a mask to protect the people around you |

This is an excerpt of an article originally published by West Hawaii Today; click here to read the article on westhawaiitoday.com.

By Laura Ruminski, West Hawaii Today

Wednesday, February 26, 2020

An ambulance for the Makalei area moved one step closer to reality Tuesday after a measure to fund and staff the proposal was passed by the Senate Committee on Ways and Means.

In its latest form, Senate Bill 2618, does not includes an appropriation. However, Sen. Dru Kanuha, a Democrat representing Kona and Ka‘u who introduced the bill with co-sponsorship of other Big Island, Oahu and Maui legislators, said that amendment is a procedural way of negotiating with the House on ultimate funding.

"Although the measure still has a long road ahead, it was great to see SB2618 SD1 passed in the Senate Committee on Ways and Means today," Kanuha said Tuesday afternoon. "With Kona Community Hospital over 30 minutes away, I am very pleased that the Legislature is taking our community's access to essential emergency services seriously."

Read more

This is a repost of an article originally published by the Hawaii Tribune-Herald; click here to read the article on hawaiitribune-herald.com.

By Stephanie Salmons, Hawaii Tribune-Herald

Thursday, February 6, 2020, 12:05 a.m.

Legislation proposed in the state Senate would help better fund teacher compensation if approved.

The current draft of Senate Bill 2488 would authorize a onetime $25 million appropriation from the state's general revenues to fund discretionary teacher salary adjustments as part of an "experimental modernization project" tackling teacher pay equity issues, pay differentials for certain teachers, or both.

"This bill is extremely important, as it addresses Hawaii's teacher shortage by providing adequate funds for teachers to receive more competitive salaries as well as pay differentials for years of service, special education, Hawaiian immersion, and hard-to-staff positions," said state Sen. Dru Kanuha, who represents Kona and Ka‘u and is a co-sponsor of the legislation. "The one-time appropriation of $25 million … is a start, but it will take consistent, long-term funding commitments to effectively resolve the needs of our hardworking public school teachers, and to provide our keiki with the quality education they deserve."

According to a Tuesday news release from the state Department of Education, an independent teacher compensation study commissioned by the department found that Hawaii's cost of living and compression of salaries for experienced educators are the top challenges in recruiting and retaining public school teachers.

The DOE launched a multi-phased initiative to address teacher compensation late last year, and on Jan. 7, a pay differential — approved by the state Board of Education in December — was implemented to increase pay for teachers in areas with the most severe shortages: special education, Hawaiian language immersion and geographically hard-to-staff schools.

For the second phase, the DOE is seeking funding for an "experimental modernization project" to address equity and compression in teacher salaries.

Pay compression happens when there is only a small difference in pay between employees, regardless of skills or experience.

The number of teachers on each step of the salary schedule is "inconsistent and compressed, contributing to senior teachers leaving the profession," according to the DOE.

This second phase will allow the department, at its discretion, to adjust pay for existing teachers if it's determined a salary is less than or equal to less experienced teachers in comparable positions.

Both the DOE and the Hawaii State Teachers Association supported SB 2488 in written testimony submitted before a Wednesday public hearing of the Senate Committee on Education.

State Superintendent Christina Kishimoto said in written testimony that the DOE will need $10.2 million in fiscal year 2020 and $30.7 million in fiscal year 2021 to implement the first phase.

"We believe the full amount is needed in order to address the issue of providing equity within our public schools," she wrote.

"Both the department and the Hawaii State Teachers Association agree that addressing the pay compression issue and teacher pay differentials will positively impact both teacher recruiting and retention," Kishimoto continued. "As such, the department is committed to phase II of the strategic initiative which will focus on the discussion on addressing this compression issue, a discussion which we look forward to having with valuable input from legislators, teachers and the community."

Other written testimony submitted before Wednesday's hearing was supportive of the funding measure.

"This salary adjustment is crucial if we want to solve the teacher shortage crisis," Hilo High School teacher Elizabeth Laliberte wrote in submitted testimony. "Good teachers want to stay in the profession but can't afford to because the high cost of living. This attrition leads to a high number of substitutes or emergency hires filling vacant positions.

"Our school has some teaching lines that haven't had a licensed teacher for almost five years," her testimony continued. "The toll this turnover takes is measured in lower morale for teachers and lowered expectations for student success. Many studies conducted on what makes effective teachers good at what they do highlight the importance of relationships. Meaningful relationships aren't possible when teachers are coming and going each year."

"Where is the political will to educate our keiki to reach their goals? Where is the incentive for our most experienced teachers to stay? Where is the incentive to encourage our youth to become teachers and stay in Hawaii?" she wrote. "Please support SB 2488 all the way through this session to become law! Our keiki need good teachers to stay and local talent to enter the teaching profession."

It was not immediately clear if the bill passed out of committee Wednesday afternoon.

According to Aloha United Way's recent ALICE report, a family of four needs to earn $77,000 a year to survive in Hawai‘i. To address large cost drivers, such as taxes, housing, and childcare, I'm proud to support the 2020 Joint Legislative Package, which addresses income inequality by providing much-needed relief for working families across Hawai‘i.

This is the first time since 2004 that the Legislature has released a joint legislative package, and the first with the support of the Governor's office. The following four bills comprise the proposal:

SB3102 / HB2541 Relating to Helping Working Families

As taxation is one of the key drivers identified in the ALICE report that contributes to increasing the cost of living for Hawai‘i's working class, SB3102 and HB2451 were introduced to make our taxation system more fair for those who are paying a higher percentage of their income to taxes. These measures make the state earned income tax credit refundable and permanent, and increases the Refundable Food/Excise Tax Credit from $110 to $150, putting cash back into people's pockets. Beginning on January 1, 2020, the minimum wage will increase to $11.00, and will increase yearly until $13.00 on January 1, 2024.

SB3104 / HB2542 Relating to Land Development

In an attempt to mitigate Hawai‘i's population loss due to its high cost of living and lack of affordable dwellings, these measures were introduced to expedite the process for developers to develop affordable units. Firstly, the measure requires the Hawai‘i Housing Finance and Development Corporation (HHFDC) identify state lands that can be developed for 99-year leasehold units. At least half of those units will be available to working-class families that earn under 140% of the area median income. These measures also appropriate $75 million in general obligation bonds to develop affordable housing infrastructure on the neighbor islands.

SB3101 / HB2543 Relating to Access to Learning ("Learning to Grow")

Hawai‘i's current lack of affordable childcare services is another major barrier for working-class families. The "Learning to Grow" initiative will address this barrier by expanding access to early learning opportunities across Hawai‘i, creating a public-private model to fund expanding the capacity of existing private childcare facilities and develop new facilities for programs serving 3- and 4-year-old children.

SB3103 / HB2544 Relating to School Facilities Agency

The State aims to establish a new School Facilities Agency to oversee major construction and facility improvement projects in Hawai‘i's public schools assigned by the Legislature, Governor, or Board of Education. The proposed Agency will relieve the Department of Education of the responsibility, and allows for public input, strong oversight of proposed projects, and gives the department the ability to focus on its primary purpose—teaching our keiki.

Mahalo to everyone who showed up to the West Hawai‘i Civic Center Council Chambers on Wednesday, July 3rd, 2019 to get updates from myself, Representative Nicole Lowen, Councilwoman Rebecca Shute-Villegas, Councilwoman Karen Eoff, and Councilwoman Maile David. We had a great turnout and received a lot of questions and suggestions that my office will be working on this upcoming session. Looking forward to continuing the conversation regarding how to maintain our beautiful West Hawai‘i community. Stay tuned for the next talk story!

Mahalo to everyone who showed up to the West Hawai‘i Civic Center Council Chambers on Wednesday, July 3rd, 2019 to get updates from myself, Representative Nicole Lowen, Councilwoman Rebecca Shute-Villegas, Councilwoman Karen Eoff, and Councilwoman Maile David. We had a great turnout and received a lot of questions and suggestions that my office will be working on this upcoming session. Looking forward to continuing the conversation regarding how to maintain our beautiful West Hawai‘i community. Stay tuned for the next talk story!

Act 181 relieves administrative burden on PAs through allowing more flexibility within the medical review process, establishing continuing medical education requirements for the renewal of PA licenses, and clarifying conditions for forfeiture and reinstatement of licenses.

A big mahalo to Senator Rosalyn H. Baker (Chair of the Senate Committee on Consumer Protection and Health) and Representative John M. Mizuno (Chair of the House Committee on Health) for all of your work seeing this bill through this past legislative session. And special shoutout to Christina Starks, President of the Hawai‘i Academy of PA's, who tirelessly pushed for the passage of this bill at the State Capitol with her ‘ohana in tow.